Congressional Budget Office

U.S. Labor Market Has Recovered Slowly and Only Partially Since the End of the Recession

posted by David

Brauer & Charles Whalen on February

27, 2014

As a companion to CBOfs The Budget and Economic Outlook:

2014 to 2024 released earlier this month, CBO released The

Slow Recovery of the Labor Market—a report that takes a closer look at

developments in the labor market since the recent recession and CBOfs

projections for the labor market for the next decade.

The Slow Recovery of the Labor Market Largely Reflects Slow Growth in Demand

for Goods and Services

The deep recession that began in December 2007, when the economy began to

contract, and ended in June 2009, when the economy began to expand again, has

had a lasting effect on the labor market. More than four and a half years after

the end of the recession, employment has risen sluggishly—much more slowly than

it grew, on average, during the four previous recoveries that lasted more than

one year. At the same time, the unemployment rate has fallen only partway back

to its prerecession level (as shown in yesterdayfs blog

post), and a significant part of that improvement is attributable to a

decline in labor force participation that has occurred as an unusually large

number of people have stopped looking for work (see the figure below). Moreover,

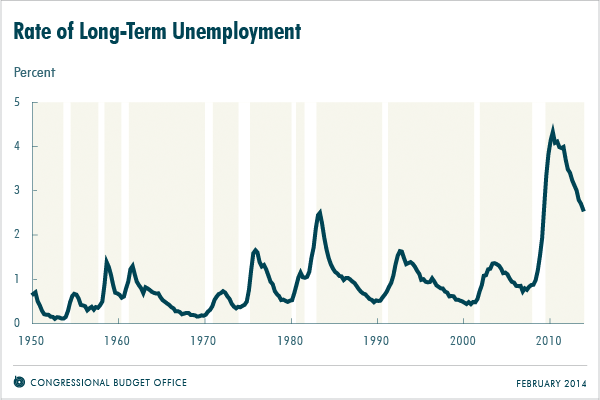

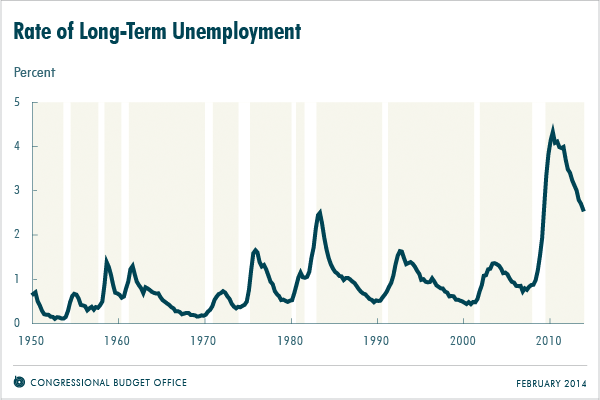

the rate of long-term unemployment—the percentage of the labor force that has

been out of work for more than 26 consecutive weeks—remains extraordinarily

high.

To a large degree, the slow recovery of the labor market reflects the slow

growth in the demand for goods and services, and hence gross domestic product

(GDP). CBO estimates that GDP was 7½ percent smaller than potential (maximum

sustainable) GDP at the end of the recession; by the end of 2013, less than

one-half of that gap had been closed. With output growing so slowly, payrolls

have increased slowly as well—and the slack in the labor market that can be seen

in the elevated unemployment rate and in part of the reduction in the rate of

labor force participation mirrors the gap between actual and potential GDP.

To a smaller degree, the slow recovery of the labor market is the result of

structural factors that stem from the recession and the slow recovery of output

but that are not directly related to the economyfs current cyclical weakness.

For example, an exceptionally large number of people have been unemployed for

long periods, and the stigma attached to their long-term unemployment, along

with a possible erosion of their job skills, has made it difficult for them to

find new work.

In assessing the slow recovery of the labor market, CBO reached the following

conclusions:

- Of the roughly 2 percentage-point net increase in the unemployment

rate between the end of 2007 and the end of 2013, the portions that

can be attributed to different factors are shown in the table

below.

| Percentage

Points |

|

| About 1 |

Cyclical weakness in demand for goods and services |

| About 1 |

Structural factors—specifically: |

| |

About ½ |

Stigma and erosion of skills from long-term unemployment |

| |

About ½ |

Decrease in efficiency of matching workers and jobs, at least

partly from mismatches in skills and locations |

- Of the roughly 3 percentage-point net decline in the labor force

participation rate between the end of 2007 and the end of 2013, the

portions that can be attributed to different factors are shown in the table

below.

| Percentage Points |

|

| About 1 ½ |

Long-term trends (primarily aging of the population) |

| About 1 |

Cyclical weakness in job prospects and wages |

| About ½ |

Discouraged workers who have dropped out of the labor force

permanently |

- Employment at the end of 2013 was about 6 million jobs

short of where it would be if the unemployment rate had returned to

its prerecession level and if the participation rate had risen to the level it

would have attained without the current cyclical weakness. Those factors

account roughly equally for the shortfall.

Over the Next Decade: A Strengthening Economy but Slow Growth in the Labor

Force

CBO expects that, under current laws governing federal taxes and spending,

output will grow more rapidly in the next few years than it has in the recent

past but recovery in the labor market will continue for some time. The agency

projects that by the second half of 2017, the gap between actual and potential

GDP will return to its average historical relationship—bringing the effects of

cyclical conditions on unemployment and labor force participation back to their

average values in 2018.

However, CBO projects, the aging of the population will further reduce labor

force participation during the coming decade, and the longer-lasting effects of

the recession and slow recovery on unemployment and the size of the labor force

will continue, albeit with diminishing magnitude, throughout the decade. All

told, CBO projects that the unemployment rate will fall to 5.8 percent by the

end of 2017 and to 5.5 percent by 2024 (compared with 4.8 percent at the end of

2007) and that the labor force participation rate will decline to 60.8 percent

by 2024 (compared with 66.0 percent at the end of 2007; see figure below).

The pace and nature of the economic recovery have been difficult to predict,

and the path of the economy and the labor market will no doubt hold surprises as

well. CBOfs projections of the labor market are subject to several sources of

uncertainty, and many developments could cause outcomes substantially different

from those CBO has projected.

David Brauer and Charles Whalen are analysts in CBOfs Macroeconomic

Analysis Division.